By Alyssa Grenfell & Jackson Carpenter, firemanual.com

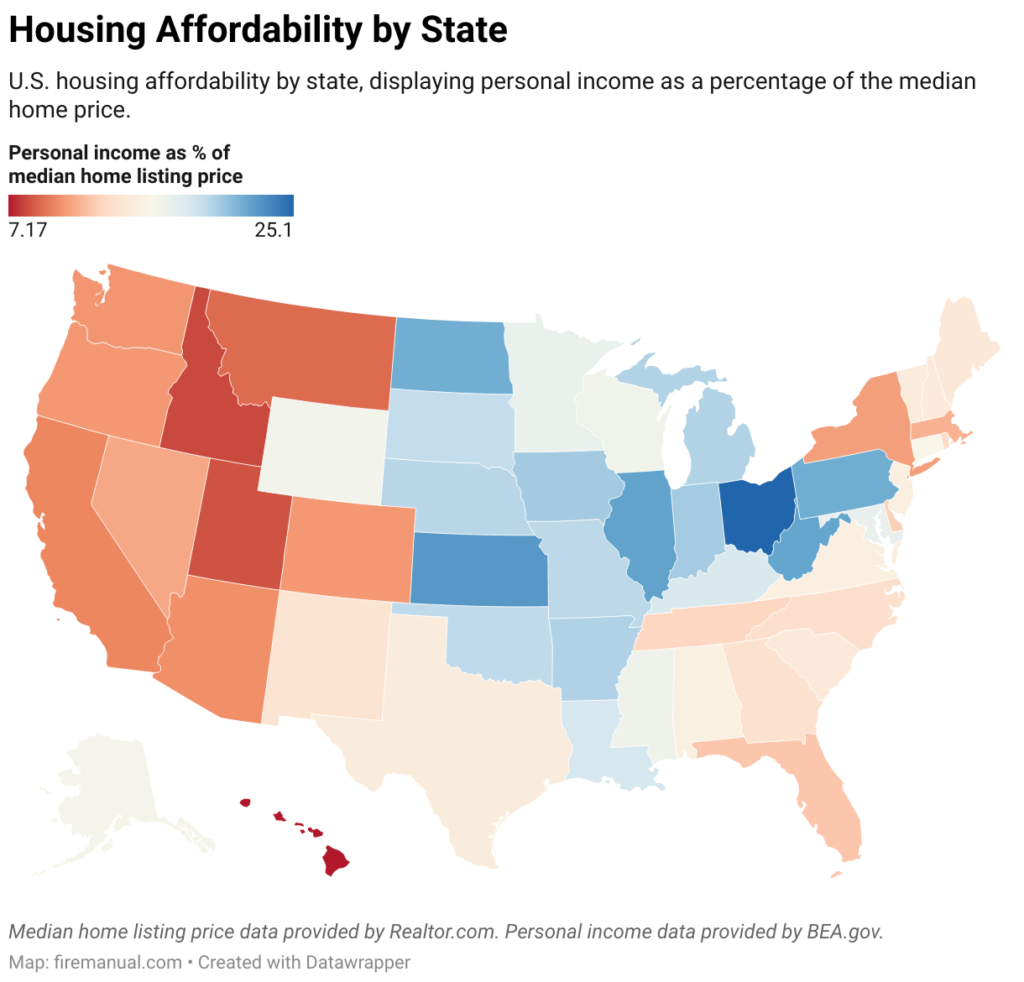

A recent analysis of U.S. housing affordability revealed what most familiar with the market already suspected: the Intermountain West is grotesquely overpriced. When measuring personal income as a percentage of the median home listing price, Idaho, Utah, and Montana rank are the second, third, and fourth least affordable states in the country (ranking only behind Hawaii, notable for its tropical beaches and less-than-abundant land).

Don’t get us wrong – having lived up and down the I-15 ourselves, we know it’s a beautiful region (with a fantastic up-and-coming tech scene in Utah’s Silicon Slopes). It is nonetheless undeniable that the market has been spurred ahead by coastal transplants and a speculative fervor that has left Boise and Salt Lake City as the country’s sixth and ninth least affordable metro areas respectively. This seems unsustainable in the long term.

Ohio meanwhile (along with much of the midwest), maintains a fantastically affordable housing market. This is a fact that the Buckeye State has leveraged in its recruiting efforts. Billboards in Austin, Texas (another famously expensive market) have been erected with “Ohio” in bold lettering alongside slogans such as, “Keep Austin Weird. Like the very high cost of living weird.” They have a point. Affordable real estate relative to wages could make Ohio an attractive option for refugees from gentrification and investors looking for a market that may be more stable in the event of a correction.

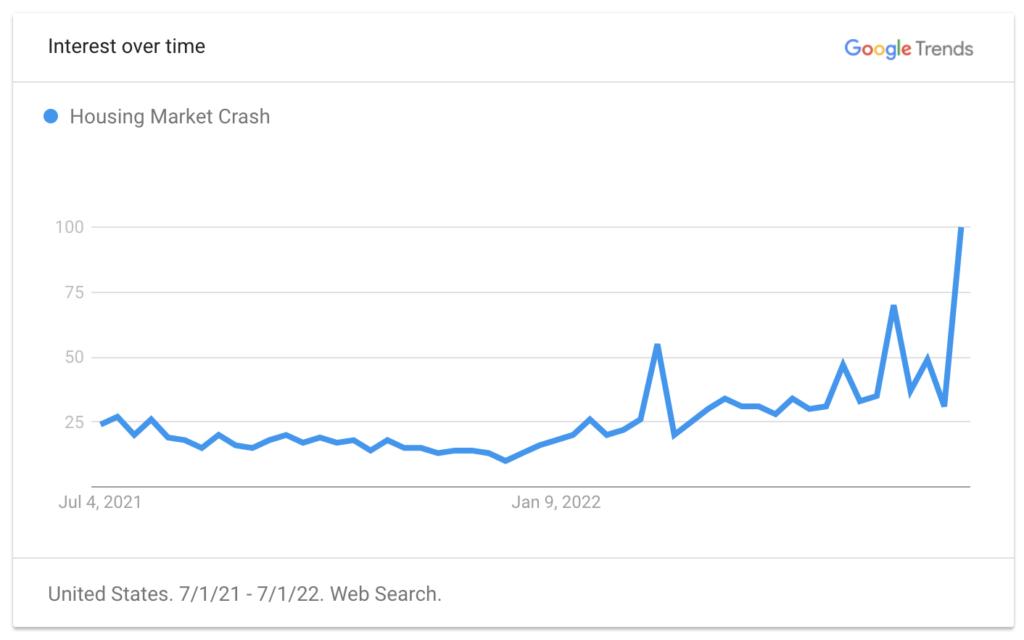

And it’s no wonder that a correction is on many of our minds. Recent rate hikes from the Fed, alongside pullbacks in prices and an increase in inventory nationally, have left many Americans wondering if a housing crash is imminent. While we’ll leave the prognostication to the economists, it is true that sentiment and price frequently feed off one another momentum. As such, it can be interesting to get a snapshot of what secret fears (or hopes) are revealed by our collective Google search history. In June, Google Search volume for the phrase “Housing Market Crash” was up roughly 300%.

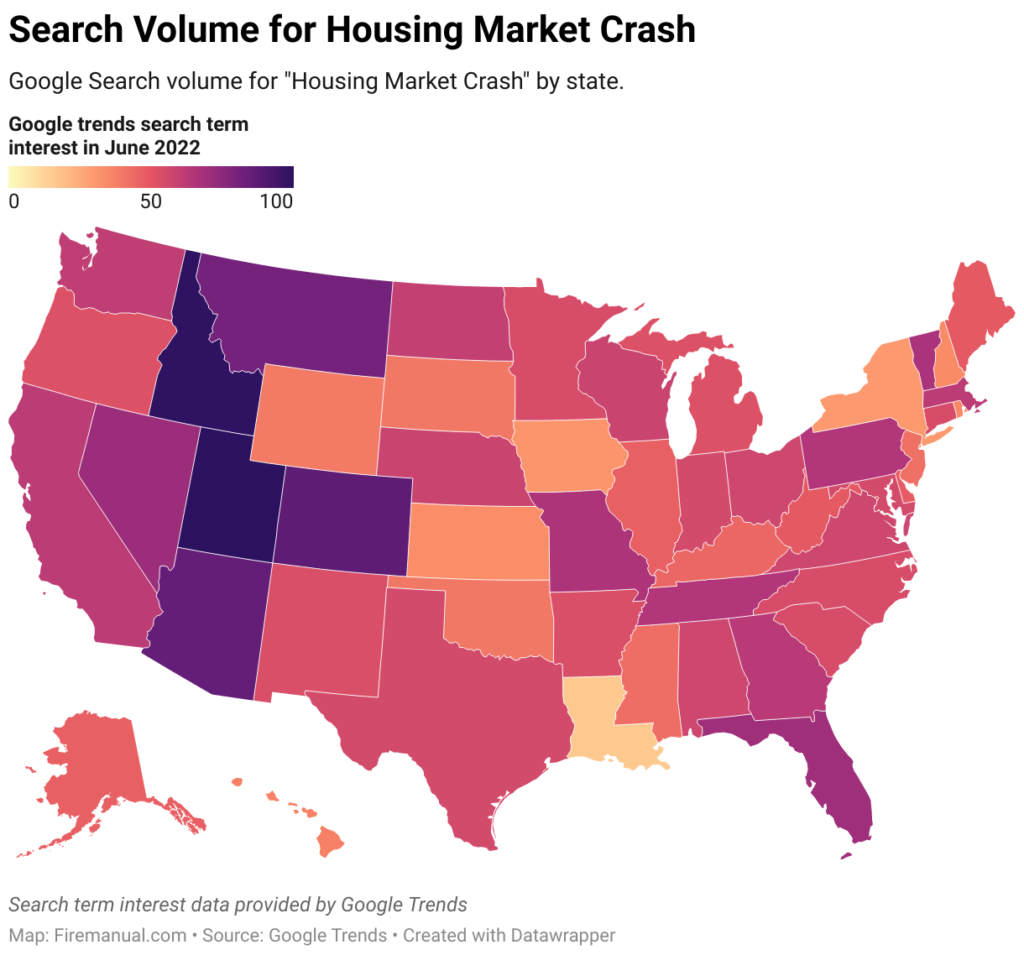

This increase in search volume was not equally distributed. Those states most fervently looking to Google for signs of a real estate crash were, unsurprisingly, in those newly unaffordable housing markets across the Intermountain West.

While we will be the first to concede that these maps paint an incomplete picture, the implications are certainly startling for bagholders who – anticipating a greater fool would soon come along – made speculative purchases in markets whose inflated prices may have furthest to fall. They also paint a picture of the opportunity in regions often overlooked as flyover country by much of the investor class. Whatever happens next, one thing is for sure: it’s going to be a shake-up.

Alyssa Grenfell and Jackson Carpenter are the cofounders and editors of FI/RE Manual, a financial independence education website. They are passionate about helping people to build sustainable wealth and find financial freedom. Alyssa also owns and operates a regional property management company. Jackson is the Vice President of Strategy for a global marketing firm.