“Oh, you hate your job? Why didn’t you say so?

There’s a support group for that. It’s called EVERYBODY, and they meet at the bar.”

― Drew Carey

These days, employers are constantly looking for ways to maximize efficiency and the almighty dollar. This mindset has created a “new normal” world where more and more traditional employees are being replaced by so-called “non employees”: independent contractors, temporary employees, and contract workers. These new employment arrangements give employers a competitive advantage by allowing them to quickly respond to changing business needs in an ever-changing economy. Over the years, courts have been eyeballing these arrangements to look for potential abuse by the employers, and our government is clamoring to capture tax dollars connected to independent contractor and temporary worker relationships. So now we have another issue to deal with: co-employment. Generally speaking, “co-employment” is an arrangement where two or more employers share employees, and each has certain legal responsibilities to the shared employees. Co-employment arrangements are becoming more popular in the commercial-real estate world, especially with landlords (or their property managers) and certain vendors. While beneficial, this arrangement can pose legal consequences.

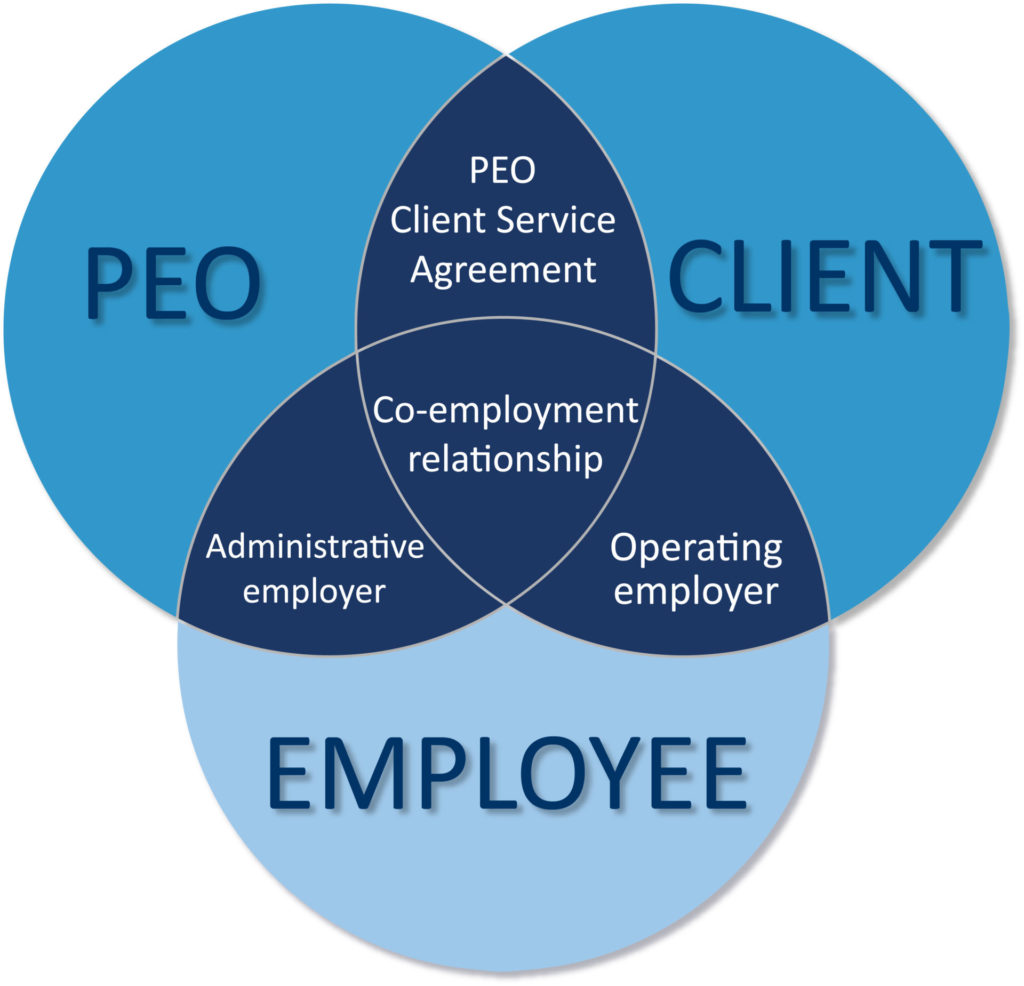

Co-employment issues can arise when an employee has two or more employers who exercise real or potential control over their duties and activates. This often comes up when utilizing temporary employees or staffing-type agencies. In most co-employment scenarios, employees technically “work” for two separate entities: the business owner, or client employer, who controls their daily duties and job functions; and the “professional employer organizations” (PEO) or staffing company, or co-employer, who handles HR-type duties and functions. Staffing agencies, “temp” agencies, and PEOs are all very similar, however, staffing and temp agencies typically just provide workers on a part-time or temporary basis, but a PEO provides services and benefits to a client employer and its existing workforce.

PEOs.

In a typical PEO-customer arrangement, the client/employer maintains control of all business decisions and operations. For example, suppose you own multiple office buildings and apartments across Texas and you employ various building engineers, janitorial staff and maintenance personnel to keep the assets in tip-top shape. Overall, your staff is excellent, but you have grown weary of all the personnel-type obligations that go along with keeping a good staff. However, if you had a co-employment arrangement with a PEO, then you would pay the PEO to handle all of the personnel duties and responsibilities so you can get rid of that headache and focus on delving quality engineering, janitorial and maintenance work for your buildings and their tenants.

As the co-employer, the PEO takes on certain, specific employer obligations, which are agreed upon by the client and the PEO. This agreement is extremely important, and should be in writing, with the duties and obligations of the PEO and the client clearly spelled out. This arrangement allows the PEO to handle functions such as recruiting, new-hire onboarding, payroll, benefits, tax payments, worker’s compensation coverage and administration, immigration paperwork, and other similar functions. Since the PEO acts as an employer for these purposes, the PEO takes on a lot more responsibility than a typical payroll company. Most PEOs also serve as a “one-stop shop” so the client doesn’t have to outsource various HR duties to multiple vendors. Keep in mind that even though the PEO performs these tasks, the customer will still be responsible for providing the proper criteria and standards for the PEO to follow. For example, if the contract with your PEO states that the PEO is responsible for recruiting new employees, the customer must communicate its desired hiring criteria to the PEO. But note that all hiring must be done in a legally compliant manner to avoid possible claims and liability, such as discrimination complaints and lawsuits.

In addition to a solid contract with your staffing company or PEO, it’s a good idea to have all contract workers sign a (legally compliant) document stating that they are employees of the staffing firm or PEO and that they waive any claim to compensation or benefits from the client.

The customer-PEO arrangement can allow the customer to mitigate certain employment-related legal risks, such as I-9 requirements, EEO reporting, payroll deductions, reporting, collecting and remitting taxes with the applicable state and federal taxing agencies. However, in the customer-PEO agreement, the PEO will likely try to get the customer to indemnify (protect) the PEO from these liabilities. This will require you to carefully review, negotiate and draft your contracts. It is also recommended that before you engage a PEO, you carefully study their staff to make sure they have competent, experienced human-resources staff members who can properly and legally handle your company’s personnel needs. Therefore, you should conduct a thorough investigation and proper due diligence before you engage a PEO, which is similar to diligence you conduct on your own employees before hiring them. For example, carefully review the biographies or curriculum vitaes for the PEO’s staff to make sure they have the proper qualifications, ask for references, and conduct background checks. This should be completed before you sign the services contract with your PEO.

CPEOs.

On December 9, 2014, President Obama signed the Tax Increase Prevention Act of 2014, which required the IRS to established a voluntary certification program for PEOs. Per the IRS requirements, a qualified PEO may be eligible for this certification. PEOs must apply for the certification with the IRS and comply with the IRS’ requirements to maintain eligibility. PEOs that have this certification are referred to as “certified professional employer organizations” or “CPEO”. Unlike PEOs that are not IRS certified, a CPEO assumes the sole responsibility for federal employment taxes for wages it pays to worksite employees. In addition, the law governing the CPEO relationship allows customers to maintain specified tax credits for which they would otherwise be eligible. It also extinguishes “wage base restarts” for new and terminating customers throughout the entire year. This could significantly reduce tax expenses and make using a CPEO a more attractive option. For example, federal unemployment taxes (FUTA) have to be paid by employers for all their employees. The FUTA tax rate is 6.0% (without state unemployment credits) and only applies to the first $7,000 paid to an employee annually. Once an employer pays that amount, they are no longer obligated to pay the FUTA tax for that year. However, if an employee is paid by a new employer in the same calendar year, then the $7,000 resets and the employer has to pay the taxes off again.

Legal Issues Related to Co-Employment and “Non-Employees”.

Way back in 2000, a well-publicized lawsuit brought co-employment issues to the forefront of business-owners’ minds. That lawsuit involved Microsoft Corporation, who wound up paying almost $100 million to settle a federal lawsuit from employees who claimed the software giant classified them as “temporary” workers for years to deny them standard benefits such as health insurance and the lucrative employee stock-purchase plan, thereby saving the company millions. As the legal battle raged on, Microsoft changed its policies for using temporary workers. First, it developed guidelines to help managers figure out when a job shouldn’t be given to a temporary employee. Then, Microsoft set up policies favoring temp agencies that offer better benefits to the temporary workers.

So how can you mitigate risks in your workplace if you use temporary employees, contractors, staffing agencies or PEOs? Below is a summary of things to watch out for and avoid:

Independent contracts should be, well, independent. They are responsible for performing a specific service for the company, the terms of which should be in a written, carefully drafted contract. The contract states what the contractor needs to accomplish, but the contractor has to decide how, when and by what means the service is provided. That seems obvious, but often the managers and supervisors who utilize contractors don’t often understand the distinction between contractors and employees. When contractors work side-by-side with the rest of the workforce, they appear to function just as a “normal” employee would. As the work load increases, the contractors can unintentionally take on new duties and start acting more and more like an employee. There are a few ways to try and avoid this problem:

- Have a specific agreement with the contractor. The supervisor plays an integral part of this process, because she is the one that really knows what the contractor’s scope of services should be. Also, the contractors should not do the same job as other employees. Try to create different and specific jobs for your contractors.

- Ensure that the supervisors are properly trained. Like most workplace problems, good communication and training are key to ensuring that managers know what their contractors’ scope of services is and can make sure they don’t start “blending in” with the workforce too much.

- Legal classifications. The IRS, the Department of Labor, the EEOC, state unemployment agencies, and other agencies, all have different classifications for what distinguishes an employee from a contractor. For example, there are three main groups of factors that the IRS uses to determine an independent contractor: behavioral control, financial control and the type of relationship of the parties. You must have someone familiar with these entire requirements serve as the company watchdog to ensure that there are no violations. Keep in mind that the biggest factor is the “control” test – it is acceptable for an employer to have complete control over its employees, but not its contractors.

- Single point of contact. Have one person who is in charge of making sure the relationships are being managed, and no one is violation. This avoids issues slipping through the cracks.

- Handling a misclassification. If you discover that a contractor is being treated as an employee, you must have a process in place to handle the “no what do we do” question. This process is often tricky because you have legal and “human” interest issues that you must address, not to mention the potential financial ramifications.

- Internal Audits. In addition to training, periodic internal audits are a good tool to assess where you are on the spectrum of compliance.

You must also be mindful of various myths and misinformation about co-employment rules. For example, some companies limit the length of service of a contract worker to under 1,500 hours over 52 weeks, based on the belief that such workers are automatically eligible for company benefits. Not only is this incorrect, but certain assignment limits may constitute an ERISA violation if they are construed as an unlawful effort to prevent workers from reaching the hours needed for plan participation. By contrast, the IRS allows companies to exclude certain people in their benefit plans as long as it is non-discriminatory. Therefore, companies can explicitly exclude certain temporary staff and independent contractors in their benefits wording. Alternatively, companies can have components of their benefits plans, such as SPPs, that are nonqualified.

Unfortunately, there is no “set-it-and-forget-it approach when it comes to co-employment and independent contractor risks. It is an ongoing process that starts with implementing solid policies and processes, is enforced by training and communication, and constant vigilance for changes in legal applications and market trends. But when done properly, it can be a win-win scenario for your company.