First-Time Homebuyer Success: 7 Essential Tips for a Smooth Purchase

Understanding Your Budget

Starting on the right foot involves knowing how much you can afford. Do you know why this is crucial? Because realistic budgeting helps you avoid financial stress down the line.

1. List all your monthly expenses. This includes utilities, groceries, transportation, and entertainment. Knowing these can help you understand what you can comfortably spend on housing.

2. Determine your monthly income after taxes. Your take-home pay is the actual amount you can allocate towards your new home’s costs.

3. Use the 28/36 rule. Financial experts recommend spending no more than 28% of your monthly income on housing and no more than 36% on total debt. This balance helps you stay financially healthy.

4. Consider future expenses. Will you need to buy furniture or make home improvements? Factor in these additional costs to avoid surprises.

Having a clear budget gives you a targeted price range, streamlining your search and saving you time. Why wait to find financial clarity? Better budgeting leads to smarter homebuying. For more comprehensive advice, check out [Real Estate Investing](https://crestnetwork.com/category/real-estate-investing/).

Getting Pre-approved for a Mortgage

Pre-approval is more than just a formality. Do you know why it’s a game-changer? Here’s why: It strengthens your bargaining position and simplifies the purchasing process.

1. Gather your financial documents. Lenders will require pay stubs, W-2s, bank statements, and tax returns. Having these ready speeds up the approval process.

2. Improve your credit score. Your credit score significantly impacts your loan terms. Pay off debts, avoid new credit inquiries, and correct any errors on your credit report.

3. Research lenders. Different institutions offer various rates and terms. Shop around to find the best deal that suits your financial situation. For more tips on navigating financial aspects, visit [Real Estate Law and Insurance](https://crestnetwork.com/category/law-insurance/).

4. Get a pre-approval letter. This document shows sellers you are a serious buyer with the funds to back up your offer. It can give you an edge in a competitive market.

Why wait for the perfect moment? Getting pre-approved can save you from unnecessary delays and disappointment. Go prepared for an efficient homebuying experience.

Choosing the Right Neighborhood

Your dream home is not just about the building but also its location. How do you know which neighborhood is best for you? Let’s find out.

1. List your priorities. Schools, parks, commuting distances, and safety are essential factors. Clearly outline what matters most to you and your family.

2. Visit at different times. A neighborhood can change throughout the day. Visit in the morning, afternoon, and evening to get a full picture of the area.

3. Talk to residents. The people who live there can offer invaluable insights about the neighborhood, including any issues you might not see on a surface level.

4. Research future developments. Planned constructions can impact property values and living conditions. Check local government websites for information about upcoming projects. For the latest trends and updates, check out [Real Estate news, Local news](https://crestnetwork.com/category/real-estate-news/).

Neighborhood choice affects your lifestyle and investment. Why compromise on location? By prioritizing your needs, you ensure a happier and more convenient living experience.

Working with a Real Estate Agent

Thinking of going solo? Reconsider. Here’s why partnering with a real estate agent can save you both time and money.

1. Tap into expert knowledge. Agents have an in-depth understanding of the market and can guide you through complex processes.

2. Access exclusive listings. Agents often have information about homes not yet on the market, giving you a headstart.

3. Negotiate effectively. A skilled agent can negotiate better terms and prices on your behalf, ensuring you get the best deal possible.

4. Handle paperwork. The homebuying process involves a lot of paperwork. An agent can help you complete all documentation accurately and efficiently. For more insights on working with professionals, you can read this article on [Real Estate Services, real estate management](https://crestnetwork.com/category/real-estate-services/).

Why take on unnecessary stress? An experienced agent can smooth the entire process, making your homebuying journey more manageable and enjoyable. Work with professionals for optimal results.

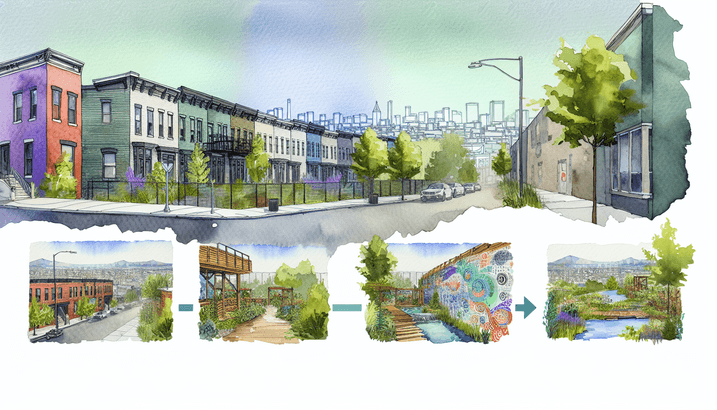

Inspecting and Evaluating the Property

Don’t judge a book by its cover. Do you know why home inspections are crucial? They reveal the true condition of the property.

1. Hire a licensed inspector. A professional inspection is worth the investment. They can identify potential problems that you might overlook.

2. Check for structural issues. Look for cracks in walls, ceilings, and floors. These can indicate deeper, more costly problems.

3. Evaluate major systems. Ensure that the plumbing, electrical, heating, and cooling systems are in working order. Repairs on these can be expensive.

4. Inspect for pests. Termites and other pests can cause significant damage. Ensure the inspection covers potential infestations.

5. Review the inspection report carefully. Ask questions if anything is unclear and use the findings to negotiate repairs or a better price. For a detailed inspection checklist, visit https://crestnetwork.com/top-10-checklist-items-home-inspection/.

Why settle for less? A thorough inspection ensures your investment is sound and minimizes unexpected expenses. Invest in quality to safeguard your future.

Sealing the Deal: Final Steps and Closing

You’re almost at the finish line. What’s next? Let’s go through the final steps to seal the deal.

1. Conduct a final walkthrough. Ensure that the property’s condition matches what was agreed upon. Check that all agreed-upon repairs have been made.

2. Review the closing disclosure. This document outlines your loan terms, monthly payments, and closing costs. Verify all the details for accuracy.

3. Prepare for closing costs. These can include loan origination fees, title searches, and transfer taxes. Make sure you have funds available.

4. Sign the closing documents. This includes your mortgage agreement and deed. Ensure you read and understand every document before signing.

5. Get the keys. Once everything is signed, you’ll receive the keys to your new home. A celebratory moment that marks the beginning of your new journey. For additional tips on navigating the final steps, visit https://crestnetwork.com/home-buying-guides-7-essential-steps-to-secure-your-dream-home-now/.

Why rush the final steps? Taking your time ensures no detail is overlooked, leading to a smooth and successful closing. Celebrate your new beginnings with confidence.