Mastering the 7 Crucial Steps to Buying Your Dream Home

Understanding Your Home-Buying Needs

What is your vision for the perfect home? Before you dive into the housing market, it’s essential to clearly identify your needs and expectations. Start by making a comprehensive list of what you must have in a home. These should include the number of bedrooms, bathrooms, and other essential features.

Do you need to be close to schools or public transport? Location is often a deal-breaker when it comes to buying a home. Make a list of your preferred neighborhoods, considering factors like commute time, safety, and amenities.

Why is it important to understand your needs? Knowing exactly what you’re looking for can save you time and reduce stress. You can filter out properties that don’t meet your criteria, narrowing down your choices effectively. For more insights on making informed decisions, click here.

List your priorities: Is a big garden more important than a modern kitchen? Rank your preferences, so when it comes down to making a tough choice, you know what aspects you can compromise on and what you can’t.

“Identifying your non-negotiables up front makes the home-buying process smoother and more straightforward.”

Involve the whole family. Discuss your lists with everyone who will be living in the home. Ensure their needs and desires are also considered – finding the balance is key.

Securing Your Finances

Ready to crunch some numbers? Financial preparation is a crucial step in buying your dream home. Knowing your budget not only helps narrow your search but also gives you an edge when it comes to negotiations. For those looking to understand the types of loans available, check out this guide on conventional loans.

First, assess your savings. How much do you have set aside for a down payment? Ideally, you should have 20% of the home’s price saved to avoid mortgage insurance.

Next, get pre-approved for a mortgage. Why is a pre-approval important? It shows sellers that you are a serious buyer with the financial backing necessary to purchase their property. Additionally, it helps you understand how much you can borrow based on your income, debt, and credit score.

What does your current debt look like? Calculate your debt-to-income ratio to understand how much you can afford monthly without stretching your finances too thin.

“A solid financial plan is the foundation of a successful home purchase.”

Review your credit score. A higher score will likely secure you a better interest rate, which can save you thousands over the life of your mortgage. Take steps to improve your credit score if necessary, such as paying down debt and correcting any errors on your credit report. For more on managing finances, visit Real Estate Sales & Leasing.

Exploring the Market and Shortlisting Options

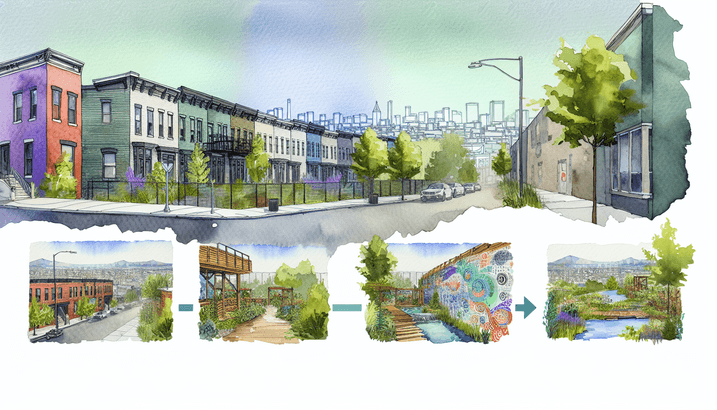

Are you ready to dive into the housing market? This phase involves extensive research and exploration. Use real estate websites, apps, and even local listings to keep abreast of the latest properties available. For a deep dive into the latest trends, read this article on 2022 predictions.

How can you ensure you’re exploring the right options? Work with a reputable real estate agent who understands your needs and the local market. They can offer invaluable insights and access to listings before they hit the public market.

Schedule viewings for the homes that catch your eye. Pay attention to the details during each visit. How’s the water pressure? What does the neighborhood sound like? Are there any visible signs of damage?

How should you keep track of potential homes? Create a comparison sheet for each property you visit. Note the pros and cons, prices, locations, and any standout features. This makes it easier to review your options when it’s time to make a decision.

“Being methodical in your approach helps you make informed decisions.”

Don’t rush this phase. Give yourself ample time to explore and compare various options. It’s better to be thorough than to make a hasty decision that you might regret later.

Making the Offer and Closing the Deal

Found your dream home? Now is the time to make an offer. Base your offer on the market data and the home’s condition. Your real estate agent can help guide you through what constitutes a fair offer. For insights on making strategic offers, visit Real Estate Investing.

What happens if your offer is accepted? The next step involves a thorough home inspection. This is crucial to identify any underlying issues that were not apparent during the initial viewings. Depending on the findings, you may want to renegotiate the price or request repairs.

What about the paperwork? You’ll need to work closely with your lender to finalize the mortgage details. Ensure that all documents are in order and that the terms are what you agreed upon.

“The closing process is a whirlwind of administration, but this diligence secures your investment.”

Get ready for the closing day. This involves signing a mountain of documents, from the deed to mortgage papers, ensuring everything is in order before the keys are handed over.

Remember, each step in this phase is critical. Taking your time and asking questions ensure you truly understand the deal you’re entering into.

Embracing Your New Home

Congratulations! You’ve closed the deal and now it’s time to embrace your new home. Start by making it your own. Unpack systematically, beginning with essential items. For inspiration on making your new space beautiful, check out Interior Design.

How can you make the transition smoother? Set up utilities before moving day to avoid any interruptions. You might also want to rekey the locks for added security.

What’s next? Introduce yourself to your neighbors. Building a good rapport with the community can enhance your living experience. They can also provide valuable information about the locality, from the best restaurants to important service contacts. For more local insights, visit this spotlight on San Antonio.

What about future plans? Consider your long-term goals for the property. Do you plan on making renovations? Are you thinking about expanding your family? Align your plans with your dreams to ensure your home grows with you. For sustainable living tips, see Sustainability.

“Turning a house into a home is a journey filled with joy and personal touches.”

Finally, take time to appreciate the journey you’ve been on. From understanding your needs to embracing your new home, every step has brought you closer to this milestone. For more detailed guides, visit this comprehensive home buying guide.