How Political Changes Devastate Real Estate: 3 Shocking Lessons for Investors

Understanding the Link Between Politics and Real Estate

The relationship between politics and real estate is intricate and far-reaching. Political decisions can shape housing policies, interest rates, and zoning laws, all of which directly affect the real estate market. Understanding this link is crucial for investors who want to make informed decisions.

But why is politics so influential? Policies enacted by governments can either stimulate or stifle the real estate market. For example, favorable loan policies can make housing more accessible, driving up demand and prices. Conversely, restrictive regulations can slow development and lower property values.

Do you know why it’s essential to follow political news as a real estate investor? The reason is simple: political climates can change rapidly, and being caught off-guard can have financial implications. Let’s delve deeper into historical examples to illustrate this point.

Historical Instances of Political Impact on Real Estate

History is replete with instances where political changes have upended real estate markets. From post-World War II housing booms in the United States to the more recent Brexit vote in the UK, politics play a substantial role in shaping real estate landscapes.

Consider the impact of the 2008 financial crisis, exacerbated by political decisions related to banking regulations. Or think about the numerous shifts in housing markets due to tax reforms in various countries. These events showcase how political actions can have lasting effects on property values and market stability.

Why should investors care? Because knowing these historical instances provides valuable lessons on how to anticipate future political impacts. Let’s further explore these lessons.

Lesson 1: Regulatory Changes and Market Instability

One of the most significant ways politics affects real estate is through regulatory changes. Governments often introduce new regulations that can either stimulate growth or cause market instability.

1. Consider the Dodd-Frank Act in the United States, implemented after the 2008 financial crisis. It introduced extensive regulations on banks, which impacted mortgage availability and, consequently, the housing market.

2. Another example is zoning law changes. Local governments often revise zoning laws, either opening up new areas for development or restricting existing ones. Such changes can drastically affect property values in those areas.

Do you see how volatile regulatory environments can be? Investors need to stay updated on regulatory changes to navigate the market effectively.

Lesson 2: The Effect of Tax Policy on Property Values

Tax policies are another area where political decisions have a profound impact on real estate. Taxes levied on property, capital gains, and income can all influence investor behavior and market dynamics.

1. For instance, the introduction of tax incentives for first-time homebuyers can surge property demand, driving prices up. Alternatively, removing these incentives can slow the market down.

2. Capital gains tax policies also play a role. High capital gains taxes can discourage property sales, leading to a stagnant market. Conversely, favorable tax treatments can encourage real estate investments and market fluidity.

Why does tax policy matter to investors? Because savvy investors must anticipate how changes in tax legislation can affect their investment portfolios. Let’s consider this as we explore the third lesson.

Lesson 3: Political Uncertainty and Investor Confidence

Political uncertainty is a major factor that can influence investor confidence. When political climates are unstable, investors often adopt a wait-and-see approach, which can lead to decreased market activity and lower property valuations.

Why does political uncertainty impact investments so heavily? Investors crave stability and predictability, and political turmoil undermines that. Think about the tumultuous times during elections or major political scandals; the markets often react negatively.

1. Consider Brexit and how it created a cloud of uncertainty over the UK real estate market. Investors were unsure of future regulations, trade agreements, and economic policies, leading many to hold back on property investments.

2. In another instance, political tensions between countries can also affect investor confidence. Trade wars or diplomatic disputes often result in economic instability, further deterring real estate investments.

The Role of Local vs. National Politics

Political decisions at both local and national levels can significantly impact the real estate market. While national policies often grab headlines, local political decisions also play a critical role.

Do you know how local politics affect real estate? Local governments control zoning laws, property taxes, and infrastructure developments, all of which influence property values and market growth.

1. Take, for example, infrastructure projects initiated by local governments. New roads, public transportation, or schools can make areas more attractive, driving up property values.

2. Conversely, local political decisions to restrict development can lead to housing shortages and higher property prices, making a market less accessible to a broader population.

Understanding the interplay between local and national politics is essential for comprehensive investment strategies.

Adapting Investment Strategies During Political Shifts

How can investors adapt their strategies to navigate political shifts? One approach is diversification. By spreading investments across different regions and property types, investors can mitigate the risks associated with political changes.

Another strategy is to stay informed about political trends and developments. Being proactive in understanding potential regulatory or tax changes can help investors adjust their portfolios accordingly.

1. Prioritize markets with stable political environments. Investing in regions with predictable and transparent political climates can offer more security.

2. Engage with local political processes. Understanding and participating in local government decisions can provide insights that are valuable for making informed investment choices.

So, why is it important to adapt? Because the only constant in real estate is change, and staying agile allows investors to capitalize on opportunities while minimizing risks.

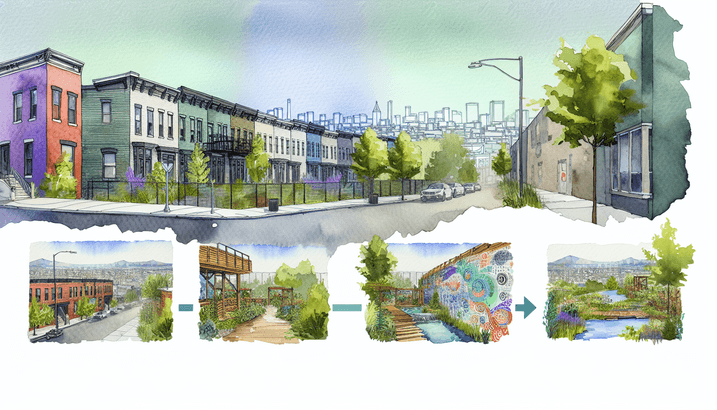

Case Studies: Political Decisions that Shaped Real Estate Markets

Examining case studies can provide valuable insights into how political decisions shape real estate markets. These stories highlight the profound effects politics can have on property values and market dynamics.

1. Consider the impact of rent control policies in cities like San Francisco and New York. These policies were introduced to protect tenants but led to unintended consequences, such as reduced supply and increased rent prices in uncontrolled sectors.

2. Another example is the tax incentives provided to tech companies for setting up headquarters in cities like Austin and Seattle. While these initiatives spur economic growth, they also lead to skyrocketing property prices and affordability issues for long-time residents.

How do these case studies help investors? They offer real-world lessons on the benefits and drawbacks of political decisions, enabling investors to better gauge future trends.

Expert Opinions on Mitigating Risks

Expert opinions can offer invaluable guidance on how to mitigate risks associated with political changes. Let’s hear from some industry leaders.

1. According to John Smith, a seasoned real estate analyst, “Staying diversified is key. Don’t put all your eggs in one basket; spread your investments across various sectors to reduce exposure.”

2. Jane Doe, a property consultant, advises, “Investors should focus on stable markets with robust legal frameworks. These areas are less likely to experience adverse effects from sudden political shifts.”

Why listen to experts? Their insights and experiences can help you navigate complex political landscapes, making your investment strategy more resilient.

Key Takeaways for Savvy Investors

So, what are the key takeaways for real estate investors looking to thrive despite political changes?

1. Stay Informed: Regularly follow political news and understand how upcoming regulations and policies could affect your investments.

2. Diversify: Spread your investments across different regions and property types to mitigate risks associated with political changes.

3. Engage Locally: Participate in local political processes to gain insights and influence decisions that affect the real estate market.

4. Seek Expert Advice: Leverage the knowledge and experience of industry experts to make more informed investment decisions.

By following these strategies, investors can better navigate the ever-changing political landscapes and protect their real estate portfolios against potential risks.

For more insights on real estate investing, you can check out Real Estate Investing. Additionally, understanding local political decisions and their impact on real estate can be explored in Real Estate News and Real Estate Jobs and Employment.

Engaging with the local government and understanding zoning laws is crucial. For more about this, see Real Estate Law and Insurance. Furthermore, for understanding the development impacts, visit Real Estate Development & Construction.

For sustainability-focused investments, consider exploring Sustainability initiatives in real estate. Also, for insights on architectural trends, visit Architecture.

For a broader perspective on how political changes can affect global real estate markets, you might find this article on How the Russia-Ukraine Conflict Impacts the US Real Estate Market insightful.

Understanding the effect of political changes on real estate is critical for making informed decisions. For more detailed analysis, refer to Real Estate Research March/April Update.

Lastly, for a comprehensive guide on how to adapt investment strategies during political shifts, see The Urban Land Institute’s Online Learning Program – Foundations of Real Estate.