Top 7 Hotspots for Lucrative Commercial Real Estate Investment in 2023

Understanding the Current Commercial Real Estate Landscape

The commercial real estate (CRE) market is buzzing with activity in 2023. With a myriad of investment opportunities spanning across various sectors, it’s essential to understand how the current landscape operates. The CRE industry is largely shaped by economic trends, technological advancements, and evolving consumer behaviors.

Do you know why these factors matter? Because they significantly influence property values and rental yields. Rising interest rates, remote work trends, and urbanization are just a few of these influential elements. Investors must keep a close eye on these trends to make informed decisions.

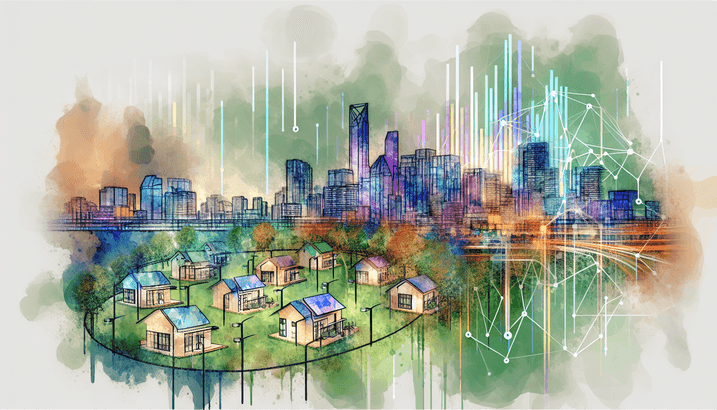

COVID-19 has necessitated changes in how businesses operate, with many companies downsizing to adaptive, flexible office spaces. This shift has opened new investment avenues, particularly in suburban markets and smaller cities. Technological integration in real estate, such as the adoption of smart building technologies, has also framed the contemporary landscape, providing both opportunities and challenges.

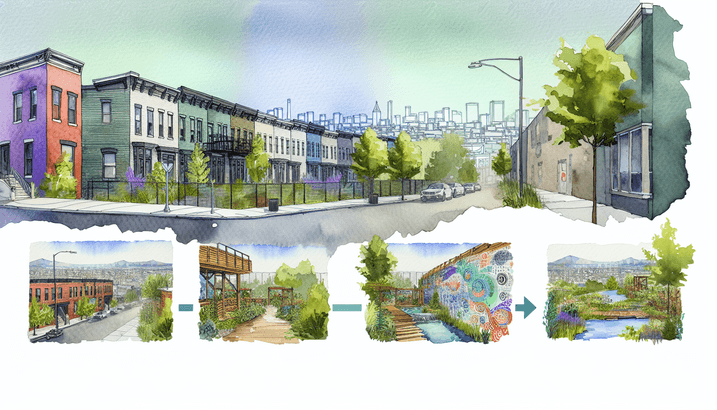

Another important aspect is the resurgence of retail spaces. With online giants like Amazon acquiring physical stores, and traditional retailers pivoting to experiential shopping, retail spaces are becoming attractive once again. What’s driving all these changes? Let’s dive deeper into the key factors shaping CRE investments this year.

Key Factors Driving Investment in 2023

What’s making 2023 a compelling year for CRE investments? Several key factors are driving this momentum, all converging to create a robust investment environment.

1. **Economic Resilience**: As economies rebound from the pandemic, industries are seeing increased activity. This resilience is creating new opportunities in CRE, particularly in growing sectors like e-commerce and healthcare.

2. **Technological Advancements**: The integration of advanced technologies in property management and tenant services is making properties more attractive to investors and tenants alike. Smart buildings and IoT (Internet of Things) capabilities are setting new standards.

3. **Remote Work Trends**: The shift toward hybrid work models is driving demand for flexible office spaces. Co-working spaces are again in vogue, catering to businesses seeking agility.

4. **Urbanization**: Continued urban development is pushing the demand for mixed-use properties that combine residential, retail, and office spaces, providing diverse revenue streams for investors.

5. **Sustainability Initiatives**: Green buildings and sustainability are no longer optional. Investors are recognizing advantages—both ethical and economic—of sustainable investments.

Why is sustainability becoming a significant factor? Let’s find out.

“Sustainable real estate practices don’t just benefit the environment; they also offer long-term cost savings and attract high-quality tenants.”

Apart from these predominant factors, let’s explore the top locations that are catching the eye of seasoned investors in 2023.

Exploring the Top 7 Hotspots

Where should you invest? Here are the top 7 hotspots for lucrative commercial real estate investment in 2023:

1. **Austin, Texas**: A tech hub with a vibrant cultural scene, Austin offers excellent potential for both office and retail investments. The city continues to attract tech giants, bolstering its economic landscape.

2. **Raleigh, North Carolina**: Driven by strong job growth and a thriving educational sector, Raleigh is becoming an irresistible destination for CRE investors, especially in the industrial and office space markets.

3. **Denver, Colorado**: Denver’s strategic location makes it a logistics and warehousing powerhouse. Its booming population and diversified economy are key factors for investment.

4. **Nashville, Tennessee**: Known for its music and healthcare industries, Nashville offers a dynamic investment environment with a steady influx of young professionals and businesses.

5. **Salt Lake City, Utah**: The city is seeing rapid growth due to its business-friendly policies and balanced lifestyle. Investments in mixed-use and office spaces are particularly promising.

6. **Orlando, Florida**: A tourist magnet, Orlando’s investment opportunities extend beyond the hospitality sector to encompass retail, office, and residential spaces.

7. **Seattle, Washington**: High demand in industrial and office sectors drives Seattle’s CRE market. The city’s strong tech scene also contributes to its attractiveness for investments.

How to Choose the Right Market for You

Now that we know the top hotspots, how do you decide which market is right for you? Here are key steps to help you with this crucial decision:

1. **Evaluate Your Budget**: Start by understanding your financial capacity. The right market for you should align with your budget constraints, allowing for both initial investment and ongoing costs.

2. **Assess Market Trends**: Review current trends in the market of interest. Is there a rising demand for certain property types? Understanding these trends helps in predicting future profitability.

3. **Location-Specific Risks**: Different markets come with unique risks. Evaluate factors like natural disasters, regulatory changes, and economic stability to ensure you’re making a well-informed choice.

4. **Growth Potential**: Prioritize markets with substantial growth potential. Cities with expanding populations, increasing job opportunities, and improving infrastructure often provide higher investment returns.

5. **Consult Local Experts**: Engage with local real estate agents or consultants. Their insights can provide valuable information on market dynamics, helping you make sound investment decisions.

“Choosing the right market is often the difference between a good investment and a great one. Take the time to do your homework.”

Why is in-depth research essential? Because it minimizes risks and maximizes potential returns. Speaking of returns, let’s discuss how you can make the most out of your investments.

Maximizing Your Return on Investment

How can you maximize your ROI in commercial real estate? Here are some effective strategies to ensure you’re getting the best bang for your buck:

1. **Diversify Your Portfolio**: Don’t put all your eggs in one basket. Diversifying your investments across different property types and locations can reduce risks and enhance returns.

2. **Focus on Value-Add Properties**: Properties that allow for value-adding improvements can significantly boost your ROI. Consider upgrades, renovations, and better property management to increase property value.

3. **Engage in Active Management**: Active and effective management of properties ensures that they remain attractive to high-quality tenants. This involves regular maintenance and proactive tenant relations.

4. **Leverage Technology**: Utilize tech tools for property management, tenant acquisition, and market analysis. Technologies like AI and IoT can provide valuable insights and streamline operations.

5. **Monitor Market Conditions**: Staying informed about market conditions allows you to make timely decisions. Whether it’s buying, selling, or holding assets, timely actions based on market insights can maximize your returns.

Why is diversification critical for maximizing ROI? Let’s find out.

“A well-diversified portfolio not only mitigates risks but also opens up multiple avenues for income generation, thereby optimizing returns.”

Keep these strategies in mind, and you’ll be well on your way to achieving financial success in commercial real estate investment. Happy investing!